UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-K

|

(Mark One)

|

|

|

|

ý

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the fiscal year ended

December 31, 2005

|

|

|

|

|

|

OR

|

|

|

|

o

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the transition period from to

|

Commission file number 333-85141

HUNTSMAN INTERNATIONAL LLC

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

87-0630358

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

500 Huntsman Way

Salt Lake City, Utah 84108

(801) 584-5700

(Address of principal executive office and telephone number)

Securities registered pursuant to Section 12(b) of

the Exchange Act: None

Securities registered pursuant to Section 12(g) of

the Exchange Act: None

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405

of the Securities Act. YES o NO ý

Indicate

by check mark if the Registrant is not required to file reports pursuant to Section 13

or Section 15(d) of the Exchange

Act. YES o NO ý

Indicate

by check mark whether the Registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Exchange Act during the

preceding 12 months (or for such shorter period that the Registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. YES ý NO o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the

best of the Registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or

any amendment to this Form 10-K. ý

Indicate

by check mark whether the Registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer.

See definition of “accelerated filer and large accelerated filer” in Rule 12b-2

of the Exchange Act. (Check one):

|

Large accelerated filer o

|

|

Accelerated filer o

|

|

Non-accelerated filer ý

|

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2

of the Exchange Act). YES o NO ý

On June 30,

2005, the last business day of the Registrant’s second fiscal quarter, all of

the Registrant’s units of membership interest were held by an affiliate.

Accordingly, the market value of units of membership interest held by

non-affiliates is zero.

On March 17,

2006, 2,058 units of membership interest of the Registrant were outstanding.

Documents Incorporated by Reference: None

The Registrant meets the conditions set forth in General

Instruction I(1)(a) and (b) of Form 10-K and is therefore filing

this form with a reduced disclosure format.

HUNTSMAN INTERNATIONAL LLC

2005 ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

i

HUNTSMAN INTERNATIONAL LLC

2005 ANNUAL REPORT ON FORM 10-K

Certain

information set forth in this report contains “forward-looking statements”

within the meaning of the federal securities laws. Forward-looking statements

include statements concerning our plans, objectives, goals, strategies, future

events, future revenues or performance, capital expenditures, financing needs,

plans or intentions relating to acquisitions and other information that is not

historical information. In some cases, forward-looking statements can be

identified by terminology such as “believes,” “expects,” “may,” “will,” “should,”

“anticipates,” or “intends” or the negative of such terms or other comparable

terminology, or by discussions of strategy. We may also make additional forward-looking

statements from time to time. All such subsequent forward-looking statements, whether

written or oral, by us or on our behalf, are also expressly qualified by these

cautionary statements.

All

forward-looking statements, including without limitation, management’s

examination of historical operating trends, are based upon our current expectations

and various assumptions. Our expectations, beliefs and projections are

expressed in good faith and we believe there is a reasonable basis for them,

but, there can be no assurance that management’s expectations, beliefs and

projections will result or be achieved. All forward-looking statements apply

only as of the date made. We undertake no obligation to publicly update or

revise forward-looking statements which may be made to reflect events or

circumstances after the date made or to reflect the occurrence of unanticipated

events.

There

are a number of risks and uncertainties that could cause our actual results to

differ materially from the forward-looking statements contained in or

contemplated by this report. Any forward-looking statements should be

considered in light of the risks set forth in “Part I. Item 1A. Risk

Factors” and elsewhere in this report.

This

report may include information with respect to market share, industry

conditions and forecasts that we obtained from internal industry research,

publicly available information (including industry publications and surveys),

and surveys and market research provided by consultants. The publicly available

information and the reports, forecasts and other research provided by

consultants generally state that the information contained therein has been

obtained from sources believed to be reliable, but there can be no assurance as

to the accuracy and completeness of such information. We have not independently

verified any of the data from third-party sources, nor have we ascertained the

underlying economic assumptions relied upon therein. Similarly, our internal

research and forecasts are based upon our management’s understanding of

industry conditions, and such information has not been verified by any

independent sources.

For

convenience in this report, the terms “Company,” “our,” “us” or “we” may be

used to refer to Huntsman International LLC and, unless the context otherwise

requires, its subsidiaries. In this report, “Huntsman Corporation” refers to

Huntsman Corporation, and, unless the context otherwise requires, its

subsidiaries, “HIH” refers to Huntsman International Holdings LLC, “Huntsman

LLC” or “HLLC” refers to Huntsman LLC, and, unless the context otherwise

requires, its subsidiaries, “AdMat Holdings” refers to Huntsman Advanced

Materials Holdings LLC and, unless the context otherwise requires, its

subsidiaries, “AdMat” refers to Huntsman Advanced Materials LLC and, unless the

context otherwise requires, its subsidiaries, “HMP” refers to HMP Equity

Holdings Corporation, “Huntsman Holdings” refers to Huntsman Holdings, LLC, “Huntsman

Family Holdings” refers to Huntsman Family Holdings Company LLC and “MatlinPatterson”

refers to MatlinPatterson Global Opportunities Partners L.P. and its affiliates.

ii

PART I

ITEM 1. BUSINESS

History

We are

a Delaware limited liability company and all of our membership interests are

owned by Huntsman Corporation. We were formed in 1999 in connection with a transaction

between HIH, Huntsman Specialty Chemicals Corporation (“Huntsman Specialty”)

and Imperial Chemical Industries PLC (“ICI”). In that transaction, on June 30,

1999, HIH acquired ICI’s polyurethane chemicals, selected petrochemicals and

titanium dioxide (“TiO2” or “Tioxide”) businesses and Huntsman

Specialty’s propylene oxide (“PO”) business. HIH also acquired the 20%

ownership interest of BP Chemicals Limited in an olefins facility located at

Wilton, U.K. and certain related assets. HIH then transferred the acquired

businesses to us and to our subsidiaries.

On August 16,

2005, we completed a merger in which Huntsman LLC, another wholly-owned

subsidiary of Huntsman Corporation, merged with and into us and we continued in

existence as the surviving entity (the “HLLC Merger”). At the same time, HIH

was also merged into our Company. Prior to the HLLC Merger, all of our

membership interests were owned by HIH, and HIH was owned 58% by Huntsman

Corporation and 42% by Huntsman LLC.

On December 20,

2005, Huntsman Corporation acquired all of the outstanding interests of AdMat

Holdings and contributed all of the outstanding equity of AdMat Holdings to us

(the “AdMat Minority Interest Transaction”). As a result, AdMat Holdings,

AdMat and its subsidiaries have become our subsidiaries. We did not pay

any consideration to Huntsman Corporation in connection with the AdMat Minority

Interest Transaction other than the issuance of additional equity to Huntsman

Corporation.

In the

AdMat Minority Interest Transaction, the equity interests of all holders in

AdMat Holdings, other than Huntsman Corporation, were converted into the right

to receive an aggregate of $125.0 million in cash (the “Minority Payment”).

In connection with the AdMat Minority Interest Transaction, we satisfied

substantially all of the Minority Payment obligation and repaid all outstanding

indebtedness of AdMat under its secured credit facility and senior secured

notes, using cash on hand and the proceeds of an increase in the term loan

under our senior secured credit facility.

For more information, see “Note 14. Long-Term Debt” to our

Consolidated Financial Statements included elsewhere in this report.

Huntsman

Corporation effected the HLLC Merger and the AdMat Minority Interest

Transaction to simplify its consolidated group’s financing and public reporting

structure, to reduce its cost of financing and to facilitate other

organizational efficiencies. The HLLC Merger and the AdMat Minority Interest

Transaction were accounted for as an exchange of shares between entities under

common control similar to the pooling method. Our consolidated financial

statements presented herein reflect the financial position, results of

operations and cash flows as if HIH, Huntsman LLC, AdMat Holdings and our

Company were combined for all periods for which they were under common control.

Prior

to the HLLC Merger and the AdMat Minority Interest Transaction, we operated our

businesses through four segments:

Polyurethanes, Performance Products, Pigments and Base Chemicals. Huntsman LLC was a manufacturer and marketer

of a wide range of chemical products with manufacturing facilities located in

North America, Europe and Australia and it operated its business through three

segments: Performance Products, Polymers and Base Chemicals. AdMat and its subsidiaries are manufacturers

and marketers of advanced epoxy, acrylic and polyurethane-based products used

in a wide variety of industrial and consumer applications and operate in a

single Advanced Materials segment. We have combined Huntsman LLC’s Performance

Products and Base Chemicals segments with our Performance Products and Base

Chemicals segments and have added Huntsman LLC’s Polymers segment and AdMat’s

Advanced Materials segment, and we now operate our business through six segments:

Polyurethanes, Advanced Materials, Performance Products, Pigments, Polymers and

Base Chemicals.

Our

six segments can be divided into two broad categories: differentiated and

commodity. We produce differentiated products primarily in our Polyurethanes,

Advanced Materials and Performance Products segments. These products serve

diverse end markets and are generally characterized by historical growth in

excess of GDP growth, resulting from product substitution and new product

development, proprietary manufacturing processes and product formulations and a

high degree of customer loyalty. Demand for these products tends to be driven

by the value-added attributes that they create in our customers’ end-use

applications. While the demand for these differentiated products is also

influenced by worldwide economic conditions and GDP growth, our differentiated

products have tended to produce more stable profit margins and higher demand

growth rates than our commodity products.

In our

commodity chemical businesses, we produce titanium dioxide derived from

titanium-bearing ores in our Pigments segment and petrochemical-based olefins,

aromatics and polyolefins products in our Polymers and Base Chemicals segments.

Since the coatings industry consumes a substantial portion of titanium dioxide

production, seasonal demand patterns in the coatings industry drive the

profitability of our Pigments segment; profitability is also driven by

industry-wide operating

1

rates, with a lag of up to twelve months due to the effects of stocking

and destocking by customers and suppliers. The profitability of our Polymers

and Base Chemicals segments has historically been cyclical in nature. The

industry has recently operated in an up cycle that resulted primarily from

strong demand reflecting global economic conditions and the fact that there

have been no recent North American or European capacity additions. However,

volatile crude oil and natural gas-based raw materials costs and a recent

weakening in demand could negatively impact the future profitability of our

Polymers and Base Chemicals segments.

Recent

Developments

Potential

Spin Off or Sale of Base Chemicals and Polymers Businesses

On

February 24, 2006, Huntsman Corporation announced that it is evaluating

strategic options for its business. This evaluation may lead to the sale of

certain of our Base Chemicals or Polymers assets or a spin off of these

segments and is consistent with the announced potential divestment discussed in

“—Pending Sale of U.S. Butadiene and MTBE Business” below. Currently, Huntsman

Corporation is in the early stages of this evaluation and there can be no

assurance that we will ultimately sell any assets or spin off our Base

Chemicals and Polymers segments.

Pending Sale

of U.S. Butadiene and MTBE Business

On February 24,

2006, Huntsman Corporation announced that it signed a letter of intent to sell

the assets of our U.S. butadiene and MTBE business operated in our Base

Chemicals segment, which includes a manufacturing facility located at Port

Neches, Texas, to Texas Petrochemicals, L.P. for a sales price of $275 million,

subject to customary adjustments. We expect the transaction to close in mid-2006.

The manufacturing facility has a capacity of approximately 900 million pounds

of butadiene per year and approximately 11,000 barrels per day of MTBE. The

business has approximately 240 employees, 2005 revenues of approximately $626

million and 2005 EBITDA of approximately $43 million.

Our PO/MTBE facilities

at Port Neches, Texas (operated in our Polyurethanes segment) and our

oxides/olefins facilities at Port Neches, Texas, along with our facilities in

nearby Port Arthur, Texas are not included in the sale.

Pending Acquisition of Textile Effects Business

On February 20,

2006, Huntsman Corporation announced that it has entered into a definitive

agreement to acquire the global Textile Effects (“TE”) business of Ciba

Specialty Chemicals Inc. for CHF 332 million ($253 million). The purchase price

will be reduced (i) by approximately CHF 75 million ($57 million) in

assumed debt and unfunded pension and other post employment liabilities and (ii) up

to approximately CHF 40 million ($31 million) in unspent restructuring costs.

The final purchase price is subject to a working capital and net debt

adjustment. The transaction is subject to customary terms and conditions, and

is expected to occur by the end of the third quarter of 2006.

The TE business has

headquarters in Basel, Switzerland, and manufactures a broad range of chemical

and dye products that enhance the performance properties and color of finished

textiles and materials. The TE business serves over 10,000 customers in 80

countries and is the leading global supplier of comprehensive solutions for the

textile industry. The TE business has approximately 4,200 employees and

operates eleven primary manufacturing facilities located in eight countries.

The TE business had approximately CHF 1.3 billion ($1 billion) in revenues and

approximately CHF 115 million ($92 million) in EBITDA in 2005. From the date of the acquisition of the TE

business through approximately the first half of 2008, we would expect to incur

restructuring costs totaling approximately $50 million and to make capital

expenditures totaling approximately $100 million associated with the TE

business.

Discussions

Concerning the Potential Sale of Huntsman Corporation

On January 31, 2006, Huntsman Corporation, our

parent, confirmed that, in late 2005, it received an indication of interest

regarding the acquisition of all of its outstanding common shares. In response

to this indication of interest, the board of directors of Huntsman Corporation

engaged financial and legal advisors to assist it in evaluating the potential

sale of Huntsman Corporation and other alternatives to enhance stockholder

value, including to continue executing its business plan. The board also formed

a special committee with authority to make a recommendation. As part of this

process, Huntsman Corporation contacted, obtained proposals from, and held

discussions with a limited number of potential acquirers or merger partners.

After careful review of the proposals received, other prospects and

alternatives available at the time, as well as thorough discussions with the

parties, the board of directors of Huntsman Corporation and its special

committee concluded that none of the proposals were in the best interests of

Huntsman Corporation stockholders.

2

Impact of 2005 U.S. Gulf Coast Storms

While

the 2005 U.S. Gulf Coast storms did not cause serious structural damage to our

facilities, they did cause operational disruptions for us and certain of our

suppliers and customers. Some of our products were temporarily negatively

impacted by restrictions on the availability of certain raw materials and our

business was adversely impacted by logistics and transportation disruptions.

Certain of our operations were suspended for much of the fourth quarter of

2005.

Energy

costs, as well as the costs of many of our key feedstocks, spiked to

unprecedented levels during the third and fourth quarters of 2005. In response

to these increased costs and tight supply conditions, we increased prices for

many of our products. Nevertheless, we estimate that these events had a direct

negative effect on our EBITDA for the six months ended December 31, 2005

of approximately $167 million, approximately $140 million of which was

incurred in the fourth quarter of 2005. The following table shows the estimated

negative impact on our EBITDA by segment for the six months ended December 31,

2005 (dollars in millions):

Estimated EBITDA* Impact

|

Segment

|

|

Six Months Ended

December 31, 2005

|

|

|

Polyurethanes

|

|

$

|

29.9

|

|

|

Advanced

Materials

|

|

2.3

|

|

|

Performance

Products

|

|

54.3

|

|

|

Pigments

|

|

3.2

|

|

|

Polymers

|

|

—

|

|

|

Base Chemicals

|

|

77.3

|

|

|

Total

|

|

$

|

167.0

|

|

* For

a discussion of EBITDA and a reconciliation of EBITDA to net income and cash

provided by operating activities, see “Part II.

Item 7. Management’s Narrative Analysis of Results of Operations—Results

of Operations.”

Related

to the continuing effects of the storms, in late January 2006, one of our

suppliers suffered two boiler failures that resulted in damages to certain of

our facilities in Jefferson County, Texas. This damage caused unplanned outages

and repair costs that we estimate will have a negative impact of approximately

$15 million on our results of operations in the first quarter of 2006. Other

than this incident, we do not expect any significant continuing impacts from the

2005 U.S. Gulf Coast storms in 2006.

We are

in the process of preparing claims for possible recovery of damages under our

insurance policies for property damage and business interruption resulting from

the 2005 U.S. Gulf Coast storms (including for the 2006 incident discussed

above at our Jefferson County, Texas facility). While we can provide no

assurances that we will recover these damages (or the amount of recovery, if

any), we anticipate obtaining at least a partial recovery, net of insurance

deductibles, by the end of 2006.

Overview

We are

among the world’s largest global manufacturers of differentiated and commodity

chemical products. We manufacture a broad range of chemical products and

formulations, which are marketed in more than 100 countries to a diversified

group of consumer and industrial customers. Our products are used in a wide

range of applications, including those in the adhesives, aerospace, automotive,

construction products, durable and non-durable consumer products, electronics,

medical, packaging, paints and coatings, power generation, refining and

synthetic fiber industries. We are a leading global producer in many of our key

product lines, including MDI, amines, surfactants, epoxy-based polymer

formulations, maleic anhydride and titanium dioxide. Our administrative,

research and development and manufacturing operations are primarily conducted

at the 67 facilities that we own or lease. Our facilities are located in 24

countries and we employ approximately 10,800 associates worldwide. Our

businesses benefit from significant integration, large production scale and

proprietary manufacturing technologies, which allow us to maintain a low-cost

position.

Our

Products and Segments

Our

business is organized around our six segments: Polyurethanes, Advanced

Materials, Performance Products, Pigments, Polymers and Base Chemicals. These

segments can be divided into two broad categories: differentiated and

commodity. We produce differentiated products primarily in our Polyurethanes,

Advanced Materials and Performance Products segments. These products serve

diverse end markets and are generally characterized by historical growth in

excess of GDP growth, resulting from product substitution and new product

development, proprietary manufacturing processes and product formulations and a

high degree of customer loyalty. Demand for these products tends to be driven

by the value-added attributes

3

that they create in our customers’ end-use applications. While the

demand for these differentiated products is also influenced by worldwide

economic conditions and GDP growth, our differentiated products have tended to

produce more stable profit margins and higher demand growth rates than our

commodity products.

In our

commodity chemical businesses, we produce titanium dioxide derived from

titanium-bearing ores in our Pigments segment and petrochemical-based olefins,

aromatics and polyolefins products in our Polymers and Base Chemicals segments.

Since the coatings industry consumes a substantial portion of titanium dioxide

production, seasonal demand patterns in the coatings industry drive the

profitability of our Pigments segment; profitability is also driven by

industry-wide operating rates, with a lag of up to twelve months due to the

effects of stocking and destocking by customers and suppliers. The

profitability of our Polymers and Base Chemicals segments has historically been

cyclical in nature. The industry has recently operated in an up cycle that

resulted primarily from strong demand reflecting global economic conditions and

the fact that there have been no recent North American or European capacity

additions. However, volatile crude oil and natural gas-based raw materials

costs and a recent weakening in demand could negatively impact the future profitability

of our Polymers and Base Chemicals segments.

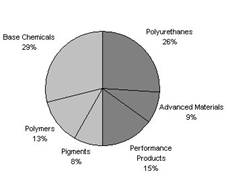

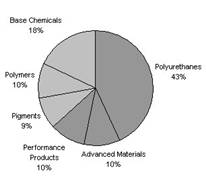

|

2005

Segment Revenues*

|

|

2005

Segment EBITDA*

|

|

|

|

|

|

|

Differentiated

|

|

|

Commodity

|

* Percentage

allocations in the segment revenues chart above reflect the allocation of all

inter-segment revenue eliminations to our Base Chemicals segment. Percentage

allocations in the segment EBITDA chart above do not give effect to $410.3 million

of corporate and other unallocated items and exclude $123.6 million of

restructuring, impairment and plant closing costs. For a detailed discussion of

our revenues, total assets and EBITDA by segment, see “Note 26. Operating

Segment Information” to our Consolidated Financial Statements included

elsewhere in this report. For a discussion of EBITDA and a reconciliation of

EBITDA to net income and cash provided by operating activities, see “Part II.

Item 7. Management’s Narrative Analysis of Results of Operations—Results

of Operations.”

The

following table identifies the key products, their principal end markets and

applications and representative customers of each of our segments:

4

|

Segment

|

|

Products

|

|

End Markets and Applications

|

|

Representative Customers

|

|

Polyurethanes

|

|

MDI, PO, polyols,

PG, TPU, aniline and MTBE(1)

|

|

automotive

interiors, refrigeration and appliance insulation, construction products,

footwear, furniture cushioning, adhesives, specialized engineering

applications and fuel additives

|

|

BMW, Electrolux,

Firestone, GE, Haier, Lear, Louisiana Pacific, Shell, Weyerhauser

|

|

|

|

|

|

|

|

|

|

Advanced

Materials

|

|

epoxy resin

compounds and formulations; cross-linking, matting and curing agents; epoxy,

acrylic and polyurethane-based adhesives and tooling resin formulations

|

|

adhesives,

aerospace, electrical power transmission, consumer electronics, civil

engineering, wind power generation and automotive

|

|

ABB, Akzo, BASF,

Boeing, Bosch, Cytec, Hexcel, Rohm & Haas, Sherwin Williams

|

|

|

|

|

|

|

|

|

|

Performance

Products

|

|

amines,

surfactants, linear alkylbenzene, maleic anhydride, other performance

chemicals, glycols, and technology licenses

|

|

detergents,

personal care products, agrochemicals, lubricant and fuel additives,

adhesives, paints and coatings, construction, marine and automotive products

and PET fibers and resins

|

|

ChevronTexaco, Colgate, Ecolab, Henkel, Monsanto,

Procter & Gamble, Unilever, Lubrizol, Reichhold

|

|

|

|

|

|

|

|

|

|

Pigments

|

|

titanium dioxide

|

|

paints and

coatings, plastics, paper, printing inks, fibers and ceramics

|

|

Akzo, Atofina, Clariant, ICI, Jotun, PolyOne

|

|

|

|

|

|

|

|

|

|

Polymers

|

|

LDPE and LLDPE,

polypropylene, EPS, styrene and APAO

|

|

flexible and

rigid packaging, adhesives and automotive, medical and construction products

|

|

Ashland, Kerr,

Kimberly Clark, Pliant, Polymer Group, PolyOne, Sealed Air

|

|

|

|

|

|

|

|

|

|

Base Chemicals

|

|

ethylene,

propylene, butadiene,(2) benzene, cyclohexane, paraxylene and MTBE(2)

|

|

packaging film,

polyester and nylon fibers, PVC, cleaning compounds, polymer resins, SBR

rubber and fuel additives

|

|

Bayer, BP,

Bridgestone/Firestone, Dow, DuPont SA, Invista, Goodyear, Nova, Shell, Solvay

|

(1) The PO/MTBE

operations in our Polyurethanes segment are not included in the announced sale

of our U.S. butadiene and MTBE business (operated in our Base Chemicals

segment). See “—Recent Developments—Pending

Sale of U.S. Butadiene and MTBE Business”

above.

(2) We have

announced the sale of our U.S. butadiene and MTBE business operated in our Base

Chemicals segment; this transaction is expected to close in mid-2006. See “—Recent Developments—Pending Sale

of U.S. Butadiene and MTBE Business” above.

Available

Information

We

maintain an Internet website at http://www.huntsman.com. Our annual reports on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K and

amendments to these reports are available free of charge through our website as

soon as reasonably practicable after we file this material with the SEC. We

also provide electronic or paper copies of our SEC filings free of charge upon

request.

ITEM 1A.

RISK FACTORS

Any of the following risks could materially and

adversely affect our business, results of operations and financial condition.

We have a history of losses and may

incur losses in the future.

We incurred net losses in four of the last five

fiscal years. We will need to continue to generate additional revenues and/or

significantly reduce costs, including interest expense, in order to avoid

additional net losses in future periods. If we do achieve profitability, we may

not sustain or increase profitability on a quarterly or annual basis.

Demand for many of our products is

cyclical, and we may experience prolonged depressed market conditions for such

products.

Historically, the markets for many of our products,

particularly our commodity products, have experienced alternating periods of

tight supply, causing prices and profit margins to increase, followed by

periods of capacity additions, resulting in oversupply and declining prices and

profit margins. Currently, several of our markets continue to experience

conditions of oversupply, and the pricing of our products in these markets is

depressed. Future growth in demand for these products may not be sufficient to

alleviate any existing or future conditions of excess industry capacity, and

such conditions may be sustained or further aggravated by anticipated or

unanticipated capacity additions or other events.

We derive a substantial portion of our revenue from

sales of commodity products. Due to the commodity nature of these products,

competition in these markets is based primarily on price and to a lesser extent

on performance, product quality, product deliverability and customer service.

As a result, we may not be able to protect our market position for these

products by product differentiation and may not be able to pass on cost

increases to our customers. Historically, the prices for our commodity products

have been cyclical and sensitive to relative changes in supply and demand, the

availability and price of feedstocks and general economic conditions. Our other

products may be subject to these same factors, but, typically, the impact of

these factors is greatest on our commodity products.

Significant price volatility or

interruptions in supply of our raw materials may result in increased costs that

we may be unable to pass on to our customers, which could reduce our

profitability.

The prices of the raw materials

that we purchase from third parties are cyclical and volatile. We purchase a

substantial portion of these raw materials from third party suppliers, and the

cost of these raw materials represents a substantial portion of our operating

expenses. The prices for a number of these raw materials generally follow price

trends of, and vary with market conditions for, crude oil and natural gas

feedstocks, which are highly volatile and cyclical. In recent periods we have

experienced significantly higher crude oil prices, which have resulted in

increased raw material prices.

Although we frequently enter into supply agreements

to acquire these raw materials, these agreements typically provide for market

based pricing and provide us only limited protection against price volatility.

While we attempt to match cost increases with corresponding product price

increases, we are not always able to raise product prices immediately or at

all. Timing differences between raw material prices, which may change daily,

and contract product prices, which in many cases are negotiated only monthly or

less often, have had and may continue to have a negative effect on

profitability. If any of our suppliers is unable to meet its obligations under

present supply agreements, we may be forced to pay higher prices to obtain the

necessary raw materials from other sources and we may not be able to increase

prices for our finished products to recoup the higher raw materials cost. In

addition, if any of the raw materials that we use become unavailable within the

geographic area from which they are now sourced, then we may not be able to

obtain suitable and cost effective substitutes. Any underlying cost increase

that we are not able to pass on to our customers or any interruption in supply

of raw materials could increase our costs or decrease our revenues, which could

reduce our profitability.

5

Natural

or other disasters could disrupt our business and result in loss of revenue or

in higher expenses.

Any

natural disaster or other serious disruption at any of our facilities due to

hurricane, fire, earthquake, flood, terrorist attack or any other natural or

man-made disaster could impair our ability to use our facilities and have a

material adverse impact on our revenues and increase our costs and expenses.

Substantially all of our revenues are derived from products manufactured at

facilities, including among others, our U.S. Gulf Coast facilities, which are

exposed to the risk of natural disasters. If there is a natural disaster or

other serious disruption at any of these facilities, it could impair our

ability to adequately supply our customers and negatively impact our operating

results. In addition, many of our current and potential customers are

concentrated in specific geographic areas. A natural disaster in one of these

regions could have a material adverse impact on our U.S. and foreign

operations, operating results and financial condition.

Our available cash and access to

additional capital may be limited by our substantial leverage, which could

restrict our ability to grow our businesses.

We reduced our indebtedness net of cash, including

outstanding borrowings under our off-balance sheet accounts receivable

securitization program, during 2005 by approximately $1.6 billion, but we

still have a substantial amount of indebtedness outstanding. As of December 31,

2005, we had total consolidated outstanding indebtedness of approximately

$4.5 billion (including the current portion of long-term debt). We may

incur substantial additional debt from time to time for a variety of purposes.

Our outstanding debt could have important consequences for our businesses, including:

• a high degree of debt will make us more

vulnerable to a downturn in our businesses, our industry or the economy in

general as a significant percentage of our cash flow from operations will be

required to make payments on our indebtedness, making it more difficult to

react to changes in our business and in market or industry conditions;

• a substantial portion of our future cash flow

from operations may be required to be dedicated to the payment of principal and

interest on indebtedness, thereby reducing the funds available for other

purposes, including the growth of our businesses;

• our ability to obtain additional financing may

be constrained due to our existing level of debt; and

• part of our indebtedness is, and any future

debt may be, subject to variable interest rates, which makes us vulnerable to

increases in interest rates.

Our existing debt instruments contain restrictive

covenants that may limit our ability to utilize our cash flow to operate our

businesses by restricting our ability to, among other things, make prepayments

of certain debt, receive dividends from our subsidiaries, make investments and

merge or consolidate and transfer or sell assets.

As of December 31, 2005, the current portion of

our long term debt totaled $44.6 million. We estimate that our annual

interest expense for 2006 will be approximately $375 million. As of December 31,

2005, we had combined outstanding variable rate borrowings of approximately

$2.3 billion. Assuming a 1% increase in interest rates, without giving

effect to interest rate hedges, our annual interest rate expense would increase

by approximately $23 million.

If we are unable to generate sufficient cash flow or

are otherwise unable to obtain the funds required to meet payments of principal

and interest on our indebtedness, or if we otherwise fail to comply with the

various covenants in the instruments governing our indebtedness, we could be in

default under the terms of those instruments. In the event of a default, a

holder of the indebtedness could elect to declare all the funds borrowed under

those instruments to be due and payable together with accrued and unpaid

interest, the lenders under our credit facilities could elect to terminate

their commitments thereunder and we or one or more of our subsidiaries could be

forced into bankruptcy or liquidation. Any of the foregoing consequences could

restrict our ability to grow our business.

6

A downgrade in the ratings of the

securities of our Company or our subsidiaries could result in increased

interest and other financial expenses related to future borrowings of our

Company or our subsidiaries and could restrict our access to additional capital

or trade credit.

Standard and Poor’s Ratings Services and Moody’s

Investors Service maintain credit ratings for us and our parent, Huntsman

Corporation. Each of these ratings is currently below investment grade. Any

decision by these or other ratings agencies to downgrade such ratings in the

future could result in increased interest and other financial expenses

relating to our future borrowings and could restrict our ability to obtain

additional financing on satisfactory terms. In addition, any downgrade could

restrict our access to, and negatively impact the terms of, trade credit

extended by our suppliers of raw materials.

Existing or future litigation or

legislative initiatives restricting the use of MTBE in gasoline may subject us

or our products to environmental liability, materially reduce our sales and/or

materially increase our costs.

We

produce MTBE, an oxygenate that is blended with gasoline to reduce vehicle air

emissions and to enhance the octane rating of gasoline. The use of MTBE has

become controversial in the U.S. and elsewhere and has been curtailed and may

be eliminated in the future by legislation or regulatory action. For example,

about 25 states have adopted rules that prohibit or restrict the use of

MTBE in gasoline sold in those states. Those states account for a substantial

portion of the “pre-ban” U.S. MTBE market. In addition, the Energy Policy Act

of 2005 is beginning to have an adverse impact on our MTBE business in the

U.S., since it mandates increased use of renewable fuels and eliminates the

oxygenate requirement for reformulated gasoline established by the 1990 Clean

Air Act Amendments. Although the extent of the potential impact of the new law

is still unclear, there have been indications that certain gasoline refiners

and distributors may stop using MTBE and that certain pipeline companies may

stop shipping gasoline containing MTBE. A significant loss in demand for our

MTBE in the U.S. could result in a material loss in revenues or material costs

or expenditures. Moreover, additional phase-outs or other future regulation of

MTBE may result in a reduction in demand for our MTBE in the U.S.

In

2005, we marketed approximately 95% of our MTBE to customers located in the

U.S. for use as a gasoline additive. Most of our 2005 sales of MTBE to U.S.

customers were made pursuant to long-term agreements. During 2006 (and

concluding by the first quarter of 2007), our long-term MTBE sales agreements

will terminate. We anticipate that our 2006 sales of MTBE in the U.S. will

decrease substantially as compared to 2005 levels. Nevertheless, we expect to

continue to sell a portion of our MTBE into the U.S. market, although not

pursuant to any new long-term agreements. We have entered into sales agreements

to sell a significant percentage of our MTBE into the Latin American market,

and we currently believe that we could also sell MTBE relatively efficiently in

Europe and Asia. Nevertheless, as a result of varying market prices and

transportation costs, sales of MTBE in markets outside the U.S. may produce

lower margins than the sale of MTBE in the U.S. We may also elect to use all or

a portion of our precursor TBA to produce saleable products other than MTBE. If

we opt to produce products other than MTBE, necessary modifications to our

facilities will require us to make significant capital expenditures and the

sale of such other products may produce a lower level of cash flow than the

sale of MTBE.

A

number of lawsuits have been filed, primarily against gasoline manufacturers,

marketers and distributors, by persons seeking to recover damages allegedly arising

from the presence of MTBE in groundwater. While we have not been named as a

defendant in any litigation concerning the environmental effects of MTBE, we

cannot provide assurances that we will not be involved in any such litigation

or that such litigation will not have a material adverse effect on our

business, results of operations and financial condition.

Our results of operations may be

adversely affected by fluctuations in currency exchange rates and international

business risks.

Some of our subsidiaries conduct a significant

portion of their business outside the U.S. These operations outside the U.S.

are subject to risks normally associated with international operations. These

risks include the need to convert currencies which may be received for our

products into currencies in which our subsidiaries purchase raw

7

materials

or pay for services, which could result in a gain or loss depending on

fluctuations in exchange rates. In addition, we translate our local currency

financial results into U.S. dollars based on average exchange rates prevailing

during the reporting period or the exchange rate at the end of that period.

During times of a strengthening U.S. dollar, our reported international sales and

earnings may be reduced because the local currency may translate into fewer

U.S. dollars. Because we currently have significant operations located in the

United Kingdom and continental Europe, we are primarily exposed to fluctuations

in the pound sterling, the euro and the Swiss franc. Furthermore, we anticipate

increased exposure to the Chinese renminbi following completion of the

construction of our MDI production facilities in China through our Chinese

joint ventures, currently expected in 2006.

Other risks of international operations include trade

barriers, tariffs, exchange controls, national and regional labor strikes,

social and political risks, general economic risks and required compliance with

a variety of foreign laws, including tax laws. Furthermore, in foreign

jurisdictions where process of law may vary from country to country, we may

experience difficulty in enforcing agreements. In jurisdictions where

bankruptcy laws and practices may vary, we may experience difficulty collecting

foreign receivables through foreign legal systems. The occurrence of these

risks could disrupt the businesses of our international subsidiaries, which

could significantly affect their ability to make distributions to us.

The industries in which we compete

are highly competitive, and we may not be able to compete effectively with our

competitors that have greater financial resources, which could reduce the

trading price of our securities.

The industries in which we operate are highly

competitive. Among our competitors are some of the world’s largest chemical

companies and major integrated petroleum companies that have their own raw

material resources. Some of these companies may be able to produce products

more economically than we can. In addition, some of our competitors have

greater financial resources, which may enable them to invest significant

capital into their businesses, including expenditures for research and

development. If any of our current or future competitors develops proprietary

technology that enables them to produce products at a significantly lower cost,

our technology could be rendered uneconomical or obsolete. Moreover, certain of

our businesses use technology that is widely available. Accordingly, barriers

to entry, apart from capital availability, are low in certain commodity product

segments of our business, and the entrance of new competitors into the industry

may reduce our ability to capture improving profit margins in circumstances

where capacity utilization in the industry is increasing. Further,

petroleum-rich countries have become more significant participants in the

petrochemical industry and may expand this role significantly in the future.

Increased competition in any of our businesses could compel us to reduce the

prices of our products, which could result in reduced profit margins and/or

loss of market share and reduce the trading price of our securities.

Our operations involve risks that may

increase our operating costs, which could reduce our profitability.

Although

we take precautions to enhance the safety of our operations and minimize the

risk of disruptions, our operations are subject to hazards inherent in the

manufacturing and marketing of differentiated and commodity chemical products.

These hazards include chemical spills, pipeline leaks and ruptures, storage

tank leaks, discharges or releases of toxic or hazardous substances or gases

and other hazards incident to the manufacturing, processing, handling,

transportation and storage of dangerous chemicals. We are also potentially subject to other

hazards, including natural disasters and severe weather; explosions and fires;

transportation problems, including interruptions, spills and leaks; mechanical

failures; unscheduled downtimes; labor difficulties; remediation complications;

and other risks.

Many

of these hazards can cause bodily injury and loss of life, severe damage to or

destruction of property and equipment and environmental damage, and may result

in suspension of operations and the imposition of civil or criminal penalties

and liabilities. Furthermore, we are subject to present and future claims with

respect to workplace exposure, exposure of contractors on our premises as well

as other persons located nearby, workers' compensation and other matters.

We maintain property, business interruption and

casualty insurance policies which we believe are in accordance with customary

industry practices, but we are not fully insured against all potential hazards

and risks incident to our business. We maintain property damage and business

interruption insurance policies with aggregate limits of $1 billion per

occurrence and products liability and sudden and accidental insurance policies

with aggregate per occurrence and annual limits of $600 million. We also

maintain insurance policies covering other types of risks, including pollution

legal liability insurance. Each of these insurance policies is subject to

customary exclusions, deductibles and coverage limits. As a result of market

conditions, premiums and deductibles for certain insurance policies can

increase substantially and, in some instances, certain insurance may become

unavailable or available

8

only

for reduced amounts of coverage. If we were to incur a significant liability

for which we were not fully insured, it could materially increase our operating

costs and therefore reduce our profitability.

In addition, we are subject to various claims and

litigation in the ordinary course of business. In conjunction with many of our

past acquisitions, we have obtained indemnity agreements from the prior owners

addressing liabilities that may arise from operations and events prior to our

ownership. We are a party to several pending lawsuits and proceedings. It is

possible that a judgment could be rendered against us in these cases or others

in which we could be uninsured or not covered by indemnity and beyond the

amounts that we currently have reserved or anticipate incurring for such

matters. See “Item 1. Business—Environmental, Health and Safety Matters” and “Item

3. Legal Proceedings.”

We are subject to many environmental

and safety regulations that may result in unanticipated costs or liabilities,

which could reduce our profitability.

We are subject to extensive federal, state, local and

foreign laws, regulations, rules and ordinances relating to pollution,

protection of the environment and the generation, storage, handling,

transportation, treatment, disposal and remediation of hazardous substances and

waste materials. Actual or alleged violations of environmental laws or permit

requirements could result in restrictions or prohibitions on plant operations,

substantial civil or criminal sanctions, as well as, under some environmental

laws, the assessment of strict liability and/or joint and several liability.

Moreover, changes in environmental regulations could inhibit or interrupt our

operations, or require us to modify our facilities or operations. Accordingly,

environmental or regulatory matters may cause us to incur significant

unanticipated losses, costs or liabilities, which could reduce our

profitability. See “Item 1. Business—Environmental, Health and Safety Matters”

and “Item 3. Legal Proceedings.”

In addition, we could incur significant expenditures

in order to comply with existing or future environmental or safety laws.

Capital expenditures and costs relating to environmental or safety matters will

be subject to evolving regulatory requirements and will depend on the timing of

the promulgation and enforcement of specific standards which impose

requirements on our operations. Capital expenditures and costs beyond those

currently anticipated may therefore be required under existing or future

environmental or safety laws.

Furthermore, we may be liable for the costs of investigating

and cleaning up environmental contamination on or from our properties or at

off-site locations where we disposed of or arranged for the disposal or

treatment of hazardous materials or from disposal activities that pre-dated our

purchase of our businesses. We may therefore incur additional costs and

expenditures beyond those currently anticipated to address all such known and

unknown situations under existing and future environmental laws. See “Item 1.

Business—Environmental, Health and Safety Matters” and “Item 3. Legal

Proceedings.”

We can provide no assurance that our internal control over our

financial reporting will be effective when Section 404 of the Sarbanes-Oxley

Act of 2002 becomes applicable to us.

Under

Section 404 of the Sarbanes-Oxley Act of 2002 and the rules issued thereunder,

our management is required to conduct an evaluation of the effectiveness of our

internal control over financial reporting as of each year-end, beginning

December 31, 2006. From that point, we will be required to include in our

annual report on Form 10-K a report on our management’s assessment of the

effectiveness of our internal control over financial reporting. Our independent registered public accounting

firm will also issue an audit report on management’s assessment and on our

internal control over financial reporting.

We

have undertaken significant efforts in preparation for the requirements of

Section 404. However, given the complexities and inherent risks associated with

the operation of internal control over financial reporting, we can provide no

assurance that our internal control over financial reporting will be effective

when Section 404 becomes applicable to us.

Moreover, we can provide no assurance as to any matters that might be

reported in our management’s assessment of our internal control over financial

reporting or our independent registered public accounting firm’s audit

report. Ineffective internal control

over financial reporting could cause investors to lose confidence in our

reported financial information and could result in a lower trading price for

our securities.

Our business is dependent on our

intellectual property. If our patents are declared invalid or our trade secrets

become known to our competitors, our ability to compete may be impaired.

Proprietary protection of our processes, apparatuses

and other technology is important to our business. Consequently, we may have to

rely on judicial enforcement of our patents and other proprietary rights. While

a presumption of validity exists with respect to patents issued to us in the

U.S., there can be no assurance that any of our patents will not be challenged,

invalidated, circumvented or rendered unenforceable. Furthermore, if any

pending patent application filed by us does not result in an issued patent, or

if patents are issued to us, but such patents do not provide meaningful

protection of our intellectual property, then our ability to compete may be

adversely affected. Additionally, our competitors or other third parties may

obtain patents that restrict or preclude our ability to lawfully produce or

sell our products in a competitive manner, which could result in significantly

lower revenues, reduced profit margins and/or loss of market share.

We also rely upon unpatented proprietary know-how and

continuing technological innovation and other trade secrets to develop and

maintain our competitive position. While it is our policy to enter into

confidentiality agreements with our employees and third parties to protect our

intellectual property, these confidentiality agreements may be breached, may

not provide meaningful protection for our trade secrets or proprietary

know-how, or adequate remedies may not be available in the event of an

unauthorized use or disclosure of our trade secrets and know-how. In addition,

others could obtain knowledge of our trade secrets through independent

development or

9

other

access by legal means. The failure of our patents or confidentiality agreements

to protect our processes, apparatuses, technology, trade secrets or proprietary

know-how could result in significantly lower revenues, reduced profit margins

and/or loss of market share.

Loss of key members of our management

could disrupt our business.

We depend on the continued employment and performance

of our senior executives and other key members of management. If any of these

individuals resigns or becomes unable to continue in his present role and is

not adequately replaced, our business operations and our ability to implement

our growth strategies could be materially disrupted. We generally do not have

employment agreements with, and we do not maintain any “key man” life insurance

for, any of our executive officers.

Terrorist attacks, such as the

attacks that occurred on September 11, 2001, the continuing military

action in Iraq, general instability in various OPEC member nations, the threat

of other attacks or acts of war in the U.S. and abroad and increased security

regulations related to our industry could adversely affect our business.

The attacks of September 11, 2001, and

subsequent events, including the continuing military action in Iraq, have

caused instability in the U.S. and other financial markets and have led, and

may continue to lead, to further armed hostilities, prolonged military action

in Iraq, or further acts of terrorism in the U.S. or abroad, which could cause

further instability in financial markets. Current regional tensions and

conflicts in various OPEC member nations, including the continuing military

action in Iraq, have caused, and may cause further, increases in raw material

costs, particularly natural gas and crude oil based feedstocks, which are used

in our operations. The uncertainty surrounding the continuing military action in

Iraq and the threat of further armed hostilities or acts of terrorism may

impact any or all of our physical facilities and operations, which are located

in North America, Europe, Australia, Asia, Africa, South America and the Middle

East, or those of our customers. Furthermore, terrorist attacks, subsequent

events and future developments in any of these areas may result in reduced

demand from our customers for our products. In addition, local, state and

federal governments have begun a regulatory process that could lead to new

regulations impacting the security of chemical plant locations and the

transportation of hazardous chemicals, which could result in higher operating

costs. These developments will subject our worldwide operations to increased

risks and, depending on their magnitude, could result in significant

unanticipated costs, lower revenues and/or reduced profit margins.

Future acquisitions, partnerships and

joint ventures may require significant resources and/or result in significant

unanticipated losses, costs or liabilities.

In the future we may seek to grow our Company and

businesses by making acquisitions or entering into partnerships and joint

ventures. Any future acquisition, partnership or joint venture may require that

we make a significant cash investment, issue stock or incur substantial debt.

In addition, acquisitions, partnerships or investments may require significant

managerial attention, which may be diverted from our other operations. These

capital, equity and managerial commitments may impair the operation of our

businesses. Furthermore, any future acquisitions of businesses or facilities

could entail a number of additional risks, including:

• problems

with effective integration of operations;

• the

inability to maintain key pre-acquisition business relationships;

• increased

operating costs;

• exposure

to unanticipated liabilities; and

• difficulties

in realizing projected efficiencies, synergies and cost savings.

We

have incurred indebtedness to finance past acquisitions. We may finance future

acquisitions with additional indebtedness and/or by issuing additional equity

securities. As a result, we could face the financial risks associated with

incurring additional indebtedness such as reducing our liquidity and access to

financing markets and increasing the amount of cash flow required to service

such indebtedness.

10

ITEM 1B.

UNRESOLVED STAFF COMMENTS

As of December 31,

2005, we did not have any unresolved comments with the staff of the SEC.

ITEM 2.

PROPERTIES

We own

or lease chemical manufacturing and research facilities in the locations

indicated in the list below which we currently believe are adequate for our

short-term and anticipated long-term needs. We own or lease office space and

storage facilities throughout the U.S. and many foreign countries. Our

principal executive offices are located at 500 Huntsman Way, Salt Lake City,

Utah 84108. The following is a list of our material owned or leased properties

where manufacturing, research and main office facilities are located.

|

Location

|

|

Business Segment

|

|

Description of Facility

|

|

Salt Lake City,

Utah

|

|

—

|

|

Executive

Offices

|

|

The Woodlands,

Texas(1)

|

|

—

|

|

Operating

Headquarters, Global Technology Center

|

|

Geismar,

Louisiana(2)

|

|

Polyurethanes

|

|

MDI,

Nitrobenzene(5), Aniline(5) and Polyols Manufacturing Facilities and

Polyurethanes Systems House

|

|

Rozenburg,

Netherlands(1)

|

|

Polyurethanes

|

|

MDI

Manufacturing Facility, Polyols Manufacturing Facilities and Polyurethanes

Systems House

|

|

Auburn Hills,

Michigan(1)

|

|

Polyurethanes

|

|

Polyurethane

Research Facility

|

|

Deerpark,

Australia

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Cartagena,

Colombia

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Deggendorf,

Germany

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Ternate, Italy

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Shanghai,

China(1)

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Thane

(Maharashtra), India(1)

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Samuprakam,

Thailand(1)

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Kuan Yin,

Taiwan(1)

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Tlalnepantla,

Mexico

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Mississauga,

Ontario(1)

|

|

Polyurethanes

|

|

Polyurethane

Systems House

|

|

Everberg,

Belgium

|

|

Polyurethanes

|

|

Polyurethane

Research Facility/Performance Products Regional HQ

|

|

Gateway West,

Singapore(1)

|

|

Polyurethanes

|

|

Polyurethane

Commercial Center

|

|

Derry, New

Hampshire(1)

|

|

Polyurethanes

|

|

TPU Research

Facility

|

|

Ringwood,

Illinois(1)

|

|

Polyurethanes

|

|

TPU

Manufacturing Facility

|

|

Osnabrück,

Germany

|

|

Polyurethanes

|

|

TPU

Manufacturing Facility

|

|

Port Neches,

Texas(3)

|

|

Polyurethanes,

Performance Products and Base Chemicals

|

|

Olefins,

Aromatics, EO, EG, Surfactants, Amines and PO Manufacturing Facilities

|

|

Wilton, U.K.

|

|

Polyurethanes and

Base Chemicals

|

|

Olefins and

Aromatics Manufacturing Facilities and Aniline and Nitrobenzene Manufacturing

Facilities

|

|

Bergkamen,

Germany(4)

|

|

Advanced

Materials

|

|

Synthesis

Facility

|

|

Monthey,

Switzerland

|

|

Advanced

Materials

|

|

Resins and

Synthesis Facility

|

|

Pamplona, Spain

|

|

Advanced

Materials

|

|

Resins and

Synthesis Facility

|

|

McIntosh,

Alabama

|

|

Advanced

Materials

|

|

Resins and

Synthesis Facility

|

|

Chennai,

India(3)

|

|

Advanced

Materials

|

|

Resins and

Synthesis Facility

|

|

Bad Saeckingen,

Germany(1)

|

|

Advanced

Materials

|

|

Formulating

Facility

|

|

Duxford, U.K.

|

|

Advanced

Materials

|

|

Formulating

Facility

|

|

Sadat City,

Egypt

|

|

Advanced

Materials

|

|

Formulating

Facility

|

|

Taboão da Serra,

Brazil

|

|

Advanced

Materials

|

|

Formulating

Facility

|

|

Panyu,

China(1)(4)

|

|

Advanced

Materials

|

|

Formulating

Facility

|

|

East Lansing,

Michigan

|

|

Advanced

Materials

|

|

Formulating

Facility

|

|

Istanbul,

Turkey(1)

|

|

Advanced

Materials

|

|

Formulating

Facility

|

|

Los Angeles,

California

|

|

Advanced

Materials

|

|

Formulating

Facility

|

|

Conroe, Texas

|

|

Performance

Products

|

|

Amines Manufacturing

Facility

|

|

Dayton, Texas

|

|

Performance

Products

|

|

Surfactant

Manufacturing Facility

|

|

Chocolate Bayou,

Texas(1)(5)

|

|

Performance

Products

|

|

LAB

Manufacturing Facility

|

|

Pensacola,

Florida(1)(5)

|

|

Performance

Products

|

|

Maleic Anhydride

Manufacturing Facility

|

|

Petfurdo,

Hungary(1)

|

|

Performance

Products

|

|

Amines

Manufacturing Facility

|

|

Botany,

Australia

|

|

Performance

Products

|

|

Surfactant

Manufacturing Facility

|

|

Llanelli, U.K.

|

|

Performance

Products

|

|

Amines

Manufacturing Facility

|

|

St. Mihiel,

France

|

|

Performance

Products

|

|

Surfactant

Manufacturing Facility

|

|

Lavera,

France(1)

|

|

Performance

Products

|

|

Surfactant

Manufacturing Facility

|

|

Castiglione,

Italy

|

|

Performance

Products

|

|

Surfactant

Manufacturing Facility

|

|

Patrica/Frosinone,

Italy

|

|

Performance

Products

|

|

Surfactant

Manufacturing Facility

|

|

Barcelona,

Spain(1)

|

|

Performance

Products

|

|

Surfactant

Manufacturing Facility

|

11

|

Whitehaven,

U.K.(1)(6)

|

|

Performance

Products

|

|

Surfactant

Manufacturing Facility

|

|

Freeport, Texas(1)

|

|

Performance

Products

|

|

Amines

Manufacturing Facility

|

|

Greatham, U.K.

|

|

Pigments

|

|

Titanium Dioxide

Manufacturing Facility

|

|

Grimsby, U.K.

|

|

Pigments

|

|

Titanium Dioxide

Manufacturing Facility

|

|

Calais, France

|

|

Pigments

|

|

Titanium Dioxide

Manufacturing Facility

|

|

Huelva, Spain

|

|

Pigments

|

|

Titanium Dioxide

Manufacturing Facility

|

|

Scarlino, Italy

|

|

Pigments

|

|

Titanium Dioxide

Manufacturing Facility

|

|

Teluk Kalung,

Malaysia

|

|

Pigments

|

|

Titanium Dioxide

Manufacturing Facility

|

|

Lake Charles,

Louisiana(7)

|

|

Pigments

|

|

Titanium Dioxide

Manufacturing Facility

|

|

Umbogintwini,

South Africa

|

|

Pigments

|

|

Titanium Dioxide

Manufacturing Facility

|

|

Billingham, U.K.

|

|

Pigments

|

|

Titanium Dioxide

Research and Technical Facility

|

|

Peru, Illinois

|

|

Polymers

|

|

EPS

Manufacturing Facility

|

|

Marysville, Michigan

|

|

Polymers

|

|

Polypropylene

Manufacturing Facility

|

|

Longview,

Texas(1)

|

|

Polymers

|

|

Polypropylene

Manufacturing Facility

|

|

Odessa, Texas

|

|

Polymers

|

|

Polyethylene

Manufacturing Facility

|

|

Mansonville,

Quebec

|

|

Polymers

|

|

EPS

Manufacturing Facility

|

|

West Footscray,

Australia

|

|

Polymers

|

|

Styrenics

Manufacturing Facility

|

|

Port Arthur,

Texas

|

|

Base Chemicals

|

|

Olefins and

Aromatics Manufacturing Facility

|

|

Sour Lake, Texas

|

|

Base Chemicals

|

|

Various finished

raw materials pipelines and storage facilities

|

|

North Tees, U.K.(1)

|

|

Base Chemicals

|

|

Aromatics

Manufacturing Facility and Logistics & Storage Assets

|

(1) Leased

land and/or building.

(2) The

Geismar facility is owned as follows: we own 100% of the MDI and polyol

facilities, and Rubicon LLC, a consolidated manufacturing joint venture with

Chemtura Corporation in which we own a 50% interest, owns the aniline and

nitrobenzene facilities. Rubicon LLC is a separate legal entity that operates

both the assets that we own jointly with Chemtura Corporation and our wholly-owned

assets at Geismar.

(3) 76%-owned

manufacturing joint venture with Tamilnadu Petroproducts Limited.

(4) 95%-owned

manufacturing joint venture with Guangdong Panyu Shilou Town Economic

Development Co. Ltd.

(5) These

plants are operated by Solutia under long-term operating agreements. Solutia

and certain of its affiliates have filed a voluntary petition for relief under

Chapter 11 of the U.S. Bankruptcy Code. We expect that Solutia will continue to

operate these plants, although no assurance can be given at this time. During

the course of the bankruptcy proceeding, it is possible that Solutia may reject

any of the agreements under which it operates the plants. It is also possible

that Solutia’s reorganization under Chapter 11 may fail and that it would

proceed to a liquidation under Chapter 7. If Solutia were to discontinue

operation of any of these plants, it may be difficult to arrange for

uninterrupted operation.

(6) We

have substantially reduced our operations at this site during 2005.

(7) 50%-owned

manufacturing joint venture with Kronos Louisiana, Inc., a subsidiary of

Kronos Worldwide, Inc.

ITEM 3.

LEGAL PROCEEDINGS

Discoloration

Claims

Certain

claims have been filed against us relating to discoloration of unplasticized

polyvinyl chloride products allegedly caused by our titanium dioxide (“Discoloration

Claims”). Substantially all of the titanium dioxide that is the subject of

these claims was manufactured prior to our acquisition of our titanium dioxide

business from ICI in 1999. Net of amounts we have received from insurers and

pursuant to contracts of indemnity, we have paid approximately $16 million

in costs and settlement amounts for Discoloration Claims as of December 31,

2005.

The

following table presents information about the number of Discoloration Claims

for the periods indicated. Claims include all claims for which service has been

received by us, and each such claim represents a plaintiff who is pursuing a

claim against us.

12

|

|

|

Year ended

December 31, 2005

|

|

Year ended

December 31, 2004

|

|

Year ended

December 31, 2003

|

|

|

Claims filed during period

|

|

0

|

|

1

|

|

1

|

|

|

Claims resolved during period

|

|

1

|

|

2

|

|

2

|

|

|

Claims unresolved at end of period

|

|

2

|

|

3

|

|

4

|

|

During

the year ended December 31, 2004, we settled claims for approximately

$45 million, approximately $30 million of which was paid by our

insurers or ICI and approximately $15 million of which was paid by us.

During 2004, we recorded charges of $15.1 million relating to Discoloration

Claims. During the year ended December 31, 2005, we settled a claim for

approximately $1 million, all of which was paid by ICI. The two Discoloration